Alliance Bank Credit Cards

Alliance Bank offers you a great diversity of card benefits which include rewards points, cashback and air miles. With Alliance Rebates You:nique Card, you can earn up to 3% unlimited cashback on retail spending. Otherwise, you can enjoy up to 5x Timeless Bonus Points (TBP) for every RM1 spent with Alliance Visa Infinite. Convert your TBP into Enrich miles or BIG points to claim FREE flight for your holiday!

Exclusive Offer!

Get guaranteed DDPAI Mola E3 Dashcam or

pick your preferred rewards either Amirates Premium Luggage 24” or Redmi Watch 5 Active.

We found 3 credit card(s) for you!

Here's some popular credit cards for your reference!

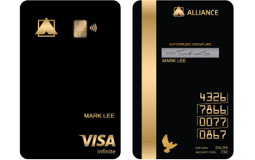

Alliance Bank Visa Infinite Credit Card

*Terms and conditions apply

- Min. Monthly Income

- RM 5,000

- Annual Fee

- Free

- Cashback

- -

Alliance Bank Visa Platinum Credit Card

*Terms and conditions apply

- Min. Monthly Income

- RM 2,000

- Annual Fee

- Free

- Cashback

- -

Alliance Bank Visa Signature Credit Card

Enjoy up to 5% Cashback On All Retail Spend i.e. Online Shopping, Petrol, Grocery, Dining, Utilities & Other Retail Spending

- Min. Monthly Income

- RM 4,000

- Annual Fee

- Free

- Cashback

- Up to 5%

Balance Transfer to any Alliance Bank credit cards

Other Credit Card categories

Still unsure about which product best suits you?

Leave your details and our friendly agents will get back to you!

How do you apply for a credit card online?

Step 1

Use our Credit Card Smart Search to find a list of cards that fits your needs! Choose the one you are interested in.

Step 2

Once you fill in your contact details, we will call you to help you apply!

Read more about Credit Card

FAQs Why get an Alliance Bank credit card?

Alliance Bank credit cards boast a strong rewards programme that can be even more rewarding when you use the bank's other financial products. They also offer attractive balance transfer rates and annual fee waivers.

Alliance Bank is holding a lot of promos right now for their credit cards. If you apply for one of their Visa Infinite, Platinum, or Visa Signature credit card, you can get up to RM600 cashback.

-

Transfer your balances from existing credit cards to your Alliance Bank card to enjoy profit rates as low as 9.88% p.a. Better yet, if you are a new-to-bank customer, you can enjoy promotional profit rates starting at 0% p.a.

-

If you want a card that can help you save on your expenses without being saddled by monthly caps or other limits, the You:nique Gold Card may be the best cashback card for you. This card offers up to 3% cashback on all retail purchases - with no restrictions on petrol, groceries or specific merchants.

-

With Alliance Bank credit cards, you get Timeless Bonus Points with every eligible RM1 spent. The Classic, Gold and Mastercard Platinum cards reward you with at least 1 point for every eligible RM1 spent locally and overseas.

But users of the Alliance Bank’s premium card, the Visa Platinum card, get a whopping 8 points for every RM1 spent on online shopping and e-wallet top ups, and 5 points for every RM1 spent on groceries and overseas transactions!

You can use your Timeless Bonus Points to redeem:â— Air miles - redeem Enrich or AirAsia air miles

â— Vouchers - redeem vouchers for Isetan, Tesco, Giant, Cold Storage, AEON and SenHeng

â— Lifestyle items - redeem gadgets, watches and home appliancesYou also get rewarded with these points when you use other Alliance Bank products, such as current/savings accounts, home financing or stock trading services. This means being able to collect points faster to earn more rewards. Best of all, these points don’t expire.

Apart from Timeless Bonus Points, Alliance Bank cardholders are also entitled to seasonal credit card promotions for restaurants and merchants. -

The minimum monthly income to qualify for an Alliance Bank card starts at RM2,000. This makes them ideal for fresh graduates who are looking for their first credit card.

-

The feature and benefits of your Alliance Bank credit card depends on which credit card you have.

-

Simply apply online with iMoney. Our representative will contact you to guide you through the

application process. -

Alliance Bank credit card is open for all Malaysians aged 21 and above, and the income requirement depends on which credit card you decide to apply for.

-

The interest rate for an Alliance Bank credit card is set at 15%. The annual fee is waived for a lifetime, meaning you won't have to pay any annual fees, and the service tax is set at RM25 monthly for your principal and supplementary card.

-

The only way you can check your credit card application status with Alliance Bank is by calling their customer service number at 03-5516 9988.

-

There are many ways you can pay your Alliance Bank credit card bill, which include;

- Cash or cheque at Alliance Bank branches nationwide

- Standing instruction (via deduction from your Alliance Bank savings or current account)

- Cheque Xpress/Cash deposit machines at selected branches

- Internet banking via allianceonline

- Automated teller machine (ATM)

- MEPS IBG at participating financial institutions

-

You can check your Alliance Bank credit card balance by logging in to Alliance Bank's Digital banking page and looking at your statement, and you can also access your statement through the Alliance Bank 's official app.

-

For a hassle-free redemption process, there are three options for you;

- Call Alliance Bank at this number

- Go to your nearest Alliance Bank branch and finally

- Fill out the redemption form and mail it to Alliance Bank Card & Payment Services, P.O. Box 13417, 50810 Kuala Lumpur, or e-mail it to info@alliancefg.com

-

Yes you can, up to 80% of your Alliance Bank credit card limit.

-

Your cash rebate will be credited to your principal credit card account in the following month’s statement of account.

-

If you want to increase your credit limit of your Alliance Bank credit card, then you can fill out this form, and submit it to any Alliance Bank branch near you.

-

The Alliance Bank credit card hotline contact number is; 03-5516 9988